FNB launches Virtual Card

FNB is continuing to lead with innovative technology by launching a Virtual Card for individual and business customers.

The Virtual Card is available to individual customers across Debit, Fusion and Credit Cards and for business customers on Debit Cards.

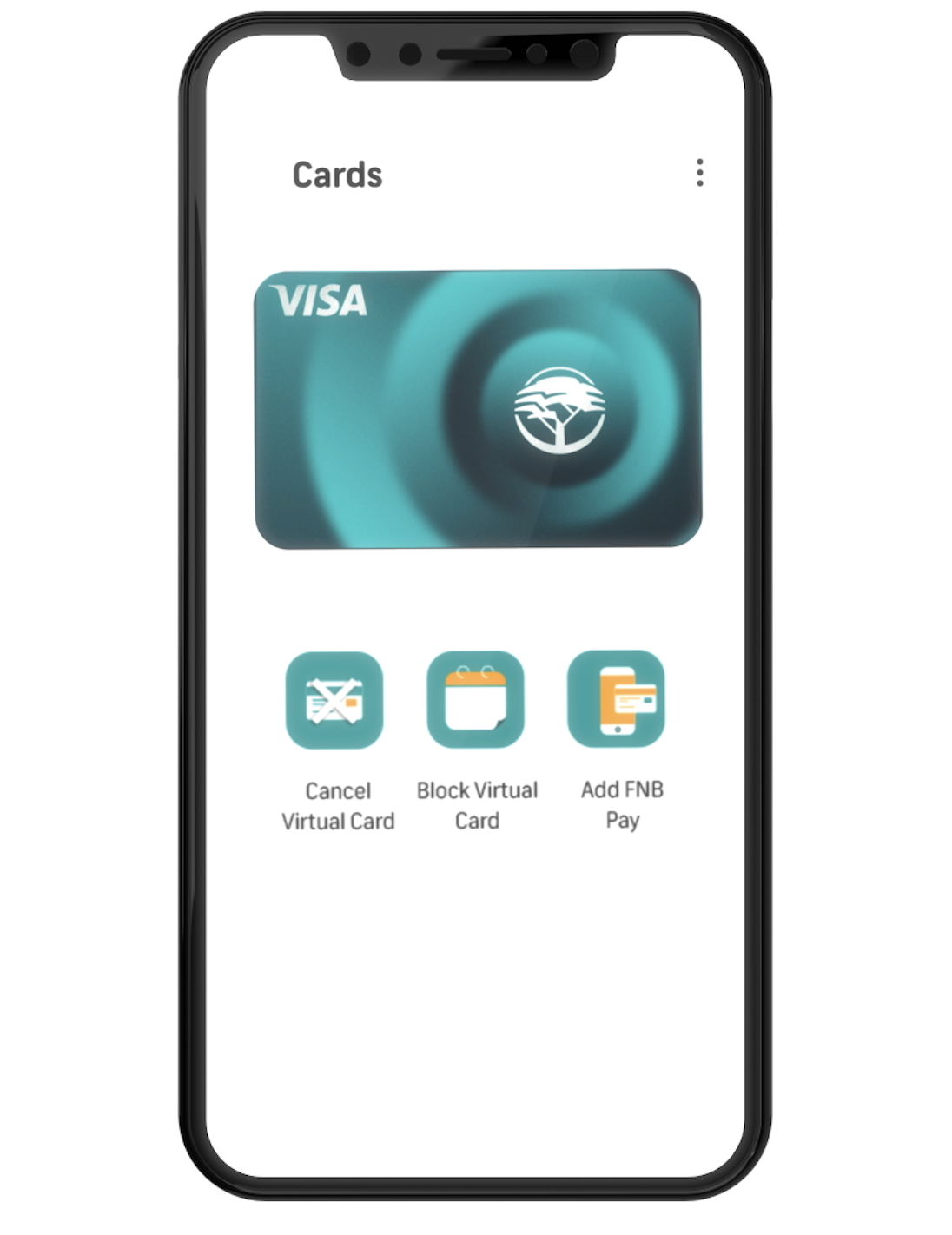

Available from October 2020, customers will access the Virtual Card via the FNB App and the RMB Private Banking App. Once available, customers can request the card anytime, anywhere at no additional cost.

App users can use Virtual Cards for QR code payments via Scan to Pay for a completely contactless digital experience at Point of Sale (POS). In addition, Android App customers with a compatible Android device can also enable their Virtual Card for Tap to Pay on the App for contactless payments.

Customers no longer need to rely on a physical card at merchants that have Tap to Pay functionality as they can either use an Android smart device, or an Apple device where the merchant accepts QR Code payments.

FNB says the Virtual Card can be loaded on trusted websites or Apps for online shopping, as well as wearable devices for contactless payments.

Chris Labuschagne, CEO of FNB Credit Card says one of the key security features on our Virtual Card is a dynamic Card Verification Value (CVV) security number that changes every hour to help customers minimise the risk of fraud when shopping online.

“The Virtual Card will be safely stored on the App and customers will have the ability to temporarily block, cancel or replace the Card via our App.”

He says the banks encryption and security features may prompt customers to authenticate a transaction on the App to reduce reliance on OTPs which make customers vulnerable to fraud.

Labuschagne says spending via Virtual Cards will provide customers with the eBucks rewards and it can also be uploaded and used on various online subscription platforms such as iTunes, Google playstore, Netflix, Spotify and more.